This statement of Fair Tax compliance was compiled in partnership with the Fair Tax Foundation (“FTF”) and certifies that Atlas Translations Limited (“the Company”) meets the standards and requirements of the FTF’s Solely UK-based Business Standard for the Fair Tax Mark certification.

Our Tax Policy

The Company is committed to paying all the taxes it owes in accordance with the spirit of all tax laws that apply to its operations. We believe paying our taxes in this way is the clearest indication we can give of being responsible participants in society. We will fulfil our commitment to paying the appropriate taxes that we owe by seeking to pay the right amount of tax, in the right place, and at the right time. We aim to do this by ensuring we report our tax affairs in ways that reflect the economic reality of the transactions that we undertake during the course of our trade.

We will not seek to use those options made available in tax law, or the allowances and reliefs that it provides, in ways that are contrary to the spirit of the law. Nor will we undertake specific transactions with the sole or main aim of securing tax advantages that would otherwise not be available to us based on the reality of the trade that we undertake. The Company will never undertake transactions that would require notification to HM Revenue & Customs under the Disclosure of Tax Avoidance Schemes Regulations or participate in any arrangement to which it might be reasonably anticipated that the UK’s General Anti-Abuse Rule might apply.

We believe tax havens undermine the UK’s tax system. As a result, while we may trade with customers and suppliers genuinely located in places considered to be tax havens, we will not make use of those places to secure a tax advantage, and nor will we take advantage of the secrecy that many such jurisdictions provide for transactions recorded within them.

Our accounts and tax filings will be prepared in compliance with this policy and we will seek to provide all the information that users, including HM Revenue & Customs, might need to properly appraise our tax position.

Our Tax Disclosures

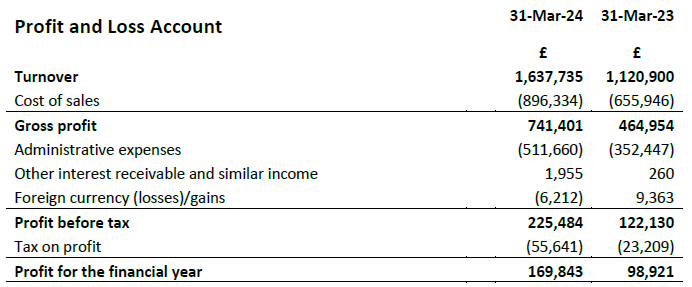

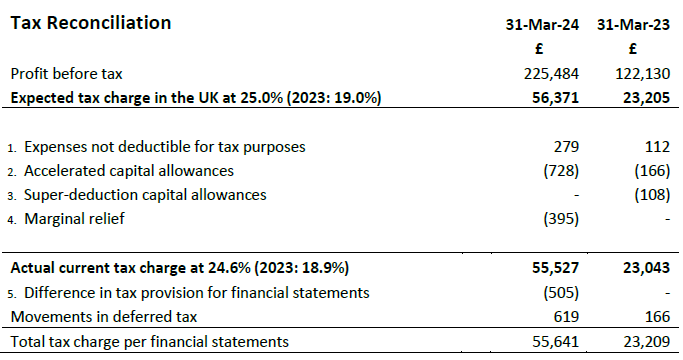

Our profit before tax for the year ended 31 March 2024 was £225,484 (2023: £122,130). The expected tax charge on this profit at the UK headline rate of 25.0% (2023: 19.0%) would be £56,371 (2023: £23,205). Our actual current tax charge for the year ended 31 March 2024 was £55,527 (2023: £23,043) at a rate of 24.6% (2023: 18.9%); and the reasons for this being lower (2023: lower) than expected are explained below in the following tax reconciliation and accompanying footnotes:

As at 31 March 2023, the Company had a deferred tax liability of £536 (2022: £370) on its Balance Sheet, after debiting £166 (2022: crediting £71) to profit and loss.

- Expenses not deductible for tax purposes – Some business expenses, although entirely appropriate for inclusion in the accounts, are not allowed as a deduction against taxable income when calculating the tax liability. An example of such expenses is client entertaining.

- Accelerated capital allowances – The accounting treatment of fixed assets differs from the tax treatment. For accounting purposes, fixed assets are depreciated over their useful economic lives. For tax purposes, there are specific rules to what can be claimed and when, depending on the type of asset (capital allowances). The differences between these treatments can often create a tax adjustment, which is only a timing difference, as eventually, the total capital allowances claimed on our tax returns will equal the total corresponding depreciation charged in our accounts on eligible assets.

We have made a provision for these temporary timing differences in our accounts (deferred tax). As at 31 March 2024, the Company had a deferred tax liability of £1,155 (2023: £536) on its balance sheet. This liability will unwind in annual instalments over the economic lives of the assets that it relates to. During the current period, a charge of £619 was released to our Profit and Loss Accounts – creating a total tax charge of £55,641 (£55,527 current tax, plus £619 deferred tax charge, less £505 prior year adjustment) in our accounts. - Super-deduction capital allowances – From 1 April 2021 to 31 March 2023, UK companies investing in qualifying new plant and machinery assets can claim a 130% super-deduction capital allowance. This extra 30% allowance creates a permanent difference above the asset’s actual cost, which won’t be resolved by depreciation and capital allowances equalling each other over the asset’s life. As this 30% tax saving is a permanent difference, not a timing difference, it has been presented separately.

- Marginal relief – From 1 April 2023, the main tax rate for companies with taxable profits over £250,000 increased from 19% to 25%. The small profits tax rate for companies with taxable profits below £50,000 stayed at 19%. For companies with taxable profits between these limits, the main tax rate is applied, but marginal relief is provided to gradually increase the Corporation Tax rate between the small profits rate and the main rate.

- Difference in tax provision for financial statements – The filing deadline for a small company’s set of accounts is 3 months before the filing deadline of its corporation tax return. If a company’s accounts and corporation tax return are not filed at the same time, then, as the accounting deadline is sooner, a provisional tax amount will be accounted for based on the knowledge of the business and its profits at that time. Later, when a company prepares its corporation tax return, it calculates the actual tax owed, which can lead to a slight difference. Our disclosures show transparency between our actual corporation tax charge and our accounting tax charge.

You can view and download our Fair Tax Mark (2024-2025) statement here.

You can view and download our Fair Tax Mark (2023-2024) statement here.